Congratulations on achieving the significant milestone of paying off your debt! Now, it’s time to shift your focus towards rebuilding and strengthening your financial stability. This article provides a comprehensive guide on how to rebuild financial stability after paying off debt, covering crucial aspects such as budgeting, saving, investing, and building an emergency fund. Learn how to leverage your newfound financial freedom to create a secure and prosperous future by developing sustainable financial habits and strategies for long-term success after becoming debt-free. Reclaiming control of your finances and establishing lasting financial stability is entirely achievable with the right approach.

Take Time to Celebrate Your Achievement

Paying off debt, especially a significant amount, is a major accomplishment. It requires discipline, sacrifice, and perseverance. Before diving into the next phase of financial planning, take a moment to acknowledge your hard work and dedication.

Celebrating doesn’t have to mean extravagant spending. The purpose is to reinforce positive behavior and mark the milestone. A small, meaningful reward can be just as effective, whether it’s a special meal, a small gift, or an experience you’ve been putting off.

Acknowledging your success helps to solidify the positive changes you’ve made and motivates you to continue making healthy financial choices in the future. It serves as a reminder of your strength and capability when facing financial challenges.

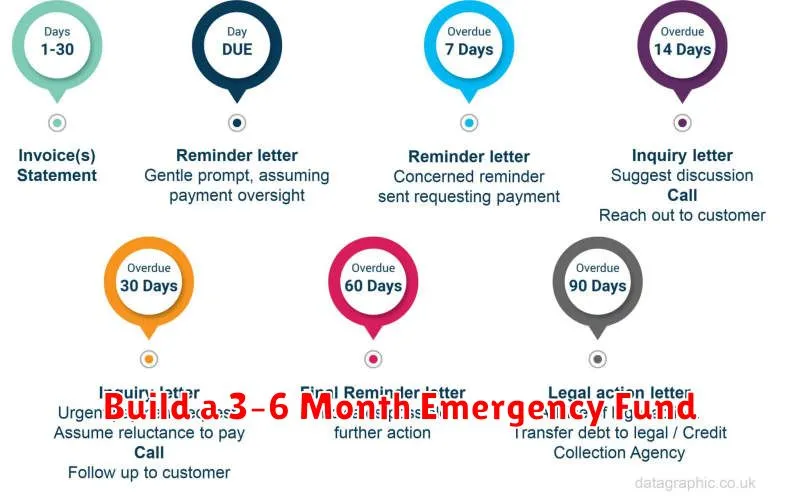

Build a 3–6 Month Emergency Fund

After tackling debt, building an emergency fund is crucial for maintaining financial stability. This fund acts as a safety net, preventing you from falling back into debt when unexpected expenses arise, such as medical bills, car repairs, or job loss.

Aim for a fund that covers 3–6 months of essential living expenses. Calculate this amount by considering your monthly necessary costs like rent/mortgage, utilities, groceries, and transportation. Avoid including non-essential expenses like dining out or entertainment.

Start small and contribute consistently. Even small weekly or bi-weekly deposits will accumulate over time. Automate these transfers to make saving easier and more consistent. Consider a separate high-yield savings account specifically designated for your emergency fund. This helps to mentally separate it from your regular spending money and potentially earn a little interest.

As your financial situation improves, gradually increase your contributions to reach your target emergency fund amount. Once you’ve reached your initial goal of 3–6 months, you might consider expanding it further for added security.

Redirect Monthly Debt Payments to Investments

Once debt is eliminated, the monthly funds previously allocated to payments become available for other purposes. A crucial step towards rebuilding financial stability is redirecting these funds towards investments. This allows you to build wealth and secure your financial future.

Determine an appropriate investment strategy based on your financial goals, risk tolerance, and time horizon. Consider options such as retirement accounts (401(k)s, IRAs), brokerage accounts for stocks and bonds, or real estate. Consistency is key; treat these redirected payments as non-negotiable, similar to how you treated your debt payments.

By diligently investing these funds, you leverage the power of compounding to grow your wealth over time. This disciplined approach helps establish a solid foundation for long-term financial security and makes progress towards achieving your financial goals.

Create a New Budget That Focuses on Growth

Congratulations on paying off your debt! This is a huge accomplishment, and now it’s time to shift your focus from debt reduction to financial growth. Creating a new budget is crucial for this next phase.

Evaluate your current spending habits. Even if you had a budget while paying down debt, it likely needs adjusting. Analyze where your money is going now. This awareness forms the foundation of your growth-focused budget.

Set new financial goals. What do you want to achieve now that you’re debt-free? Is it saving for a down payment, investing for retirement, or building an emergency fund? Clearly defined goals provide direction for your budget.

Prioritize saving and investing. Treat savings and investments as essential expenses. Allocate a specific portion of your income towards these goals before considering discretionary spending. The amount will depend on your individual goals and circumstances.

Automate your savings. Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and removes the temptation to spend the money elsewhere.

Continuously monitor and adjust. Regularly review your budget to ensure it aligns with your goals and reflects your current financial situation. Be prepared to make adjustments as needed. Life changes, and your budget should be flexible enough to adapt.

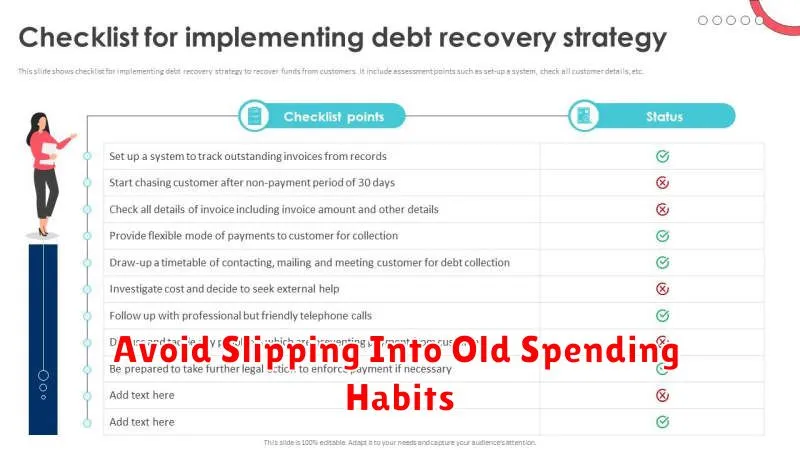

Avoid Slipping Into Old Spending Habits

Paying off debt is a major accomplishment, but maintaining financial stability requires ongoing effort. One of the biggest challenges is avoiding the temptation to fall back into old spending patterns. These habits likely contributed to the debt in the first place, so it’s crucial to develop new, healthier financial behaviors.

Budgeting is paramount. Track your income and expenses meticulously to understand where your money is going. A budget provides a clear picture of your financial situation and empowers you to make informed spending choices.

Resist the urge to immediately increase your spending just because you have more available cash flow. Consider continuing to make the same debt payments, but now direct those funds toward savings or investments. This creates a financial cushion and helps build long-term wealth.

Be mindful of emotional spending. Celebratory spending after becoming debt-free is understandable, but set limits. Recognize triggers for emotional spending and develop strategies to manage them, such as delaying purchases or finding alternative, less expensive ways to reward yourself.

Finally, establish clear financial goals. Having a purpose for your money, whether it’s saving for a down payment, retirement, or simply building an emergency fund, provides motivation to stay on track and avoid reverting to old spending habits.

Set Clear Long-Term Financial Goals

After the arduous journey of debt repayment, it’s crucial to establish clear long-term financial goals. This provides direction and motivation to maintain your newly acquired financial stability and build a secure future.

Begin by identifying your long-term priorities. Do you envision early retirement, purchasing a home, funding your children’s education, or securing a comfortable retirement nest egg? Clearly defining these aspirations allows you to develop a roadmap for achieving them.

Translate your priorities into specific, measurable, achievable, relevant, and time-bound (SMART) goals. Instead of a vague goal like “save more money,” aim for something concrete, such as “accumulate a $50,000 down payment for a house within five years.” This specificity allows for better tracking and adjustment of your financial plan.

Prioritize your goals. You may have multiple long-term aspirations. Determine which goals are most important and tackle them strategically. Focusing on one or two key goals at a time can prevent feeling overwhelmed and increase your chances of success.

Finally, regularly review and adjust your goals as needed. Life circumstances and priorities can change over time. Periodically reassessing your goals ensures they remain aligned with your current situation and aspirations.

Keep Tracking Expenses to Stay Grounded

After achieving the significant milestone of paying off debt, it’s crucial to maintain momentum and build lasting financial stability. One of the most effective ways to do this is to continue diligently tracking expenses. Tracking expenses provides valuable insights into spending habits and helps prevent a relapse into debt.

While it may seem tedious, consistent monitoring of where your money goes allows you to identify areas where you can continue saving and make informed decisions about future spending. This is especially important after paying off debt, as the money previously allocated to debt payments can now be redirected towards other financial goals like saving for retirement or building an emergency fund.

Budgeting apps and spreadsheets can be valuable tools in this process, simplifying the task of tracking and categorizing expenses. By visualizing your spending patterns, you can identify unnecessary expenses and make adjustments accordingly. This continued awareness of your financial inflows and outflows will help solidify your newly acquired financial stability and empower you to make sound financial decisions moving forward.