Managing debt effectively is crucial for improving your credit score. This article explores proven strategies to help you navigate debt while simultaneously boosting your creditworthiness. Learn how to improve your credit score, manage debt responsibly, and understand the essential connection between debt management and a healthy credit score. Discover practical tips for debt reduction, smart credit utilization, and building a stronger financial future.

Understand How Credit Scores Are Calculated

Your credit score is a numerical representation of your creditworthiness, summarizing your credit history into a three-digit number. Understanding how this number is calculated is crucial for effective credit management.

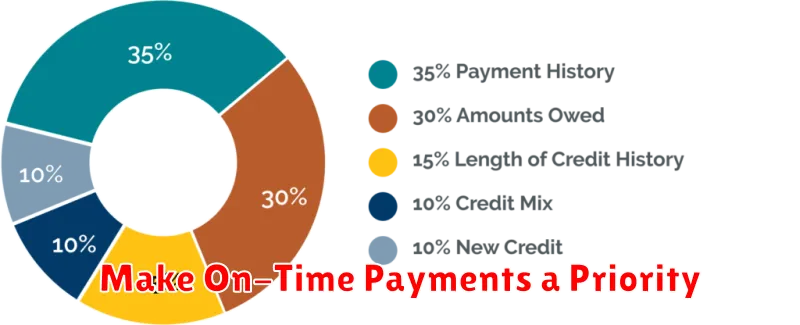

Several factors contribute to your credit score, each weighted differently. Payment history is the most significant, accounting for roughly 35% of your score. Making on-time payments consistently demonstrates responsible credit behavior.

Amounts owed make up about 30% of your score. This doesn’t simply refer to the total debt you hold, but rather your credit utilization ratio – the percentage of available credit you are using. Keeping your balances low relative to your credit limits is key.

The length of your credit history contributes 15%. A longer history provides more data for lenders to assess your creditworthiness. New credit accounts for 10% and refers to the number of recently opened accounts. Opening multiple new accounts in a short period can be seen as a risk. Finally, credit mix (10%) refers to the variety of credit accounts you hold (e.g., credit cards, installment loans). While not as impactful as other factors, having a diverse mix can slightly improve your score.

Different credit scoring models exist, with FICO being the most commonly used. While the specific algorithms are complex, understanding these key factors empowers you to take control of your credit health.

Make On-Time Payments a Priority

Your payment history is the most significant factor influencing your credit score. Even one missed payment can have a negative impact, and the effect is amplified the longer a payment remains overdue. Prioritize paying all your bills, including credit cards, loans, and utilities, by their due dates.

Set up automatic payments whenever possible to avoid accidental late payments. If you anticipate difficulty making a payment, contact your creditors immediately. They may be willing to work with you on a payment plan to avoid damaging your credit further.

Consistently paying on time, even if it’s only the minimum payment, demonstrates responsible credit management and will contribute positively to your credit score over time. This consistent behavior is key to rebuilding and maintaining good credit while managing existing debt.

Lower Credit Utilization Rates

Your credit utilization rate is the percentage of your available credit that you’re currently using. It’s a significant factor in your credit score. A high utilization rate suggests to lenders that you might be overextended financially, even if you consistently make your payments on time.

To calculate your credit utilization, divide your total outstanding credit card balances by your total available credit. For example, if you owe $2,000 on cards with a combined $10,000 limit, your utilization rate is 20%.

Ideally, you should keep your credit utilization below 30%, and lower is even better. A utilization rate below 10% is often considered excellent. Even if you can pay your balances in full each month, a high utilization reported to the credit bureaus can negatively impact your score.

There are several ways to lower your credit utilization. You can pay down your balances aggressively, increase your credit limits (though be mindful of the potential temptation to spend more), or spread your spending across multiple cards. Be strategic about these methods and monitor your utilization rate regularly to track your progress.

Avoid Opening Too Many New Accounts

Opening several new credit accounts in a short period can significantly lower your credit score. Each new account application triggers a hard inquiry on your credit report, which can temporarily deduct a few points. Multiple hard inquiries in a short timeframe can signal to lenders that you’re experiencing financial difficulty and are seeking credit out of desperation. This can make you appear risky.

Furthermore, new accounts lower your average account age. A longer credit history with established accounts generally reflects greater financial responsibility and contributes positively to your score. Opening multiple new accounts lowers this average, potentially impacting your score negatively. Therefore, avoid applying for new credit unless absolutely necessary, especially when actively working to improve your credit and manage debt.

Check and Dispute Credit Report Errors

Regularly reviewing your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) is crucial for identifying and addressing inaccuracies that can negatively impact your credit score. These errors might include incorrect personal information, accounts that don’t belong to you, inaccurate payment history, or duplicate accounts.

If you find an error, dispute it immediately with the respective credit bureau. Provide clear and concise documentation supporting your claim, such as account statements or proof of identity. The bureau is legally obligated to investigate the dispute and correct any verified inaccuracies.

Follow up on your dispute to ensure it’s resolved promptly. While the investigation is ongoing, the disputed item may appear on your credit report with a notation that it’s being investigated. Once resolved, ensure the correction is reflected accurately in your credit reports.

Keep Old Credit Lines Open If Possible

One significant factor influencing your credit score is the length of your credit history. Closing old credit card accounts, even if you’ve paid them off, can shorten your credit history and potentially lower your score.

A longer credit history demonstrates responsible financial behavior over time, which lenders view favorably. By keeping older accounts open, you maintain a more established credit history, positively impacting your credit score.

Another key factor is your credit utilization ratio, which is the percentage of available credit you’re currently using. Closing older accounts can decrease your total available credit, potentially increasing your credit utilization ratio. A higher utilization rate suggests a higher risk to lenders, which can negatively impact your score. Even if you don’t use the older cards, keeping them open helps maintain a lower utilization ratio.

Be mindful of annual fees. If an older card has an annual fee that outweighs the benefits of keeping it open, consider contacting the issuer to request a product change to a no-fee card. This allows you to retain the account’s positive history without incurring additional costs.

Track Your Score Monthly to Stay Motivated

Regularly monitoring your credit score is crucial for staying motivated throughout your debt management and credit improvement journey. Checking your score monthly allows you to see the impact of your efforts, providing positive reinforcement when you see improvements. This can be especially encouraging during the initial stages when progress may seem slow.

Tracking your score also helps you identify any potential errors or discrepancies quickly. Catching these issues early can prevent further damage to your credit and save you time and frustration in the long run.

Finally, consistent monitoring allows you to adjust your strategy as needed. If you aren’t seeing the desired results, you can analyze your spending and repayment habits and make necessary changes to get back on track. This proactive approach is key to successfully improving your credit score while managing debt.