Are you worried about a family member struggling with debt? Do you want to help them regain their financial footing without jeopardizing your own financial stability? This article provides practical and effective strategies for helping a family member with debt without going broke yourself. Learn how to offer debt help that truly makes a difference, from initiating sensitive conversations to exploring debt relief options and establishing healthy financial boundaries. Discover how to navigate this delicate situation and provide meaningful debt support while protecting your own financial well-being.

Understand Their Situation Without Judging

Before offering help, take the time to truly understand your family member’s financial situation. This requires open and honest communication, where you listen more than you speak. Avoid judgment or placing blame, as this will likely shut down the conversation and make them less receptive to your support. Debt can arise from a variety of factors, including job loss, medical expenses, unexpected life events, or poor financial management. Approach the conversation with empathy and compassion, recognizing that they are likely already feeling stressed and overwhelmed.

Focus on understanding the scope of their debt, including the types of debt (credit cards, loans, medical bills, etc.), the total amount owed, and the current interest rates. Ask open-ended questions like, “Can you tell me more about how this happened?” or “What are your biggest concerns right now?” This information will be crucial in helping you determine the best course of action and the type of support you can realistically offer.

Remember, offering help doesn’t mean solving all their problems. Your role is to provide support and guidance, not to become their financial savior. Understanding their situation without judgment creates a safe space for them to be vulnerable and honest, paving the way for a more productive conversation about potential solutions.

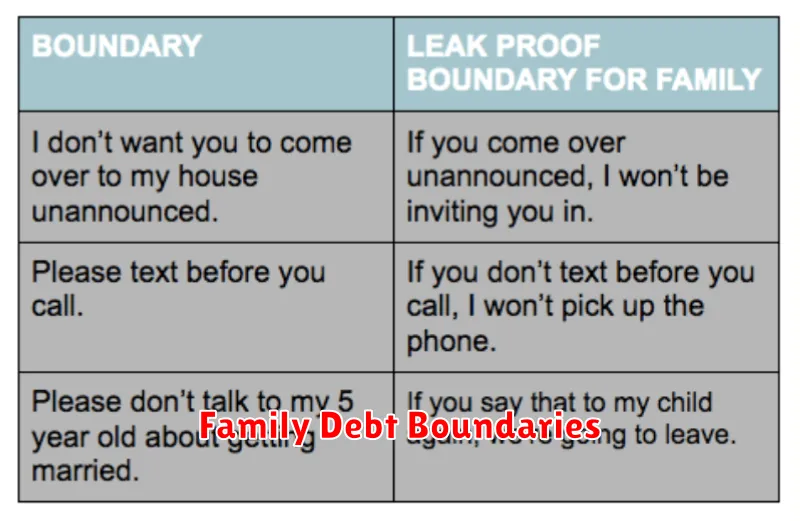

Set Clear Boundaries Before Offering Help

Helping a family member struggling with debt can be emotionally challenging. It’s crucial to establish clear boundaries before offering any assistance to protect yourself both financially and emotionally. Define exactly what kind of help you’re willing to provide. This might include creating a budget with them, offering advice based on your own experience, or connecting them with a financial advisor.

What you should not do is enable their debt. Clearly communicate that you will not be paying off their debts for them. This can be a difficult conversation, but it’s essential for both your financial well-being and their long-term growth. Explain that your goal is to help them become financially independent, not to become their source of ongoing financial rescue.

Set a firm limit on the amount of financial help you’re willing to give, if any. This might mean a one-time contribution toward a specific expense, like credit counseling, or a small, short-term loan with a clear repayment plan. Having these boundaries established upfront can help prevent resentment and strained relationships down the line.

Be prepared to enforce your boundaries consistently. It can be difficult to say no to a loved one, particularly when they are struggling. However, wavering on your boundaries can send mixed messages and ultimately prolong the cycle of debt. Remember that setting boundaries is not only about protecting yourself, but also about encouraging your family member to take responsibility for their own financial situation.

Offer Non-Financial Support First (Time, Tools)

Before offering financial assistance, consider providing non-monetary support, which can be incredibly valuable and less risky for your own financial well-being. Time is a precious commodity. Offering to help with childcare, errands, or meal preparation can free up time for your family member to focus on tackling their debt. This can reduce stress and allow them to dedicate more energy to finding solutions, like a second job or budgeting effectively.

Tools and resources can also make a significant difference. Perhaps you have budgeting software you can share, or you’re skilled in creating spreadsheets. Offer to help them organize their finances and develop a budget. You could also research and share reputable credit counseling services or debt management resources. This type of practical assistance can empower them to take control of their finances without directly involving your own money.

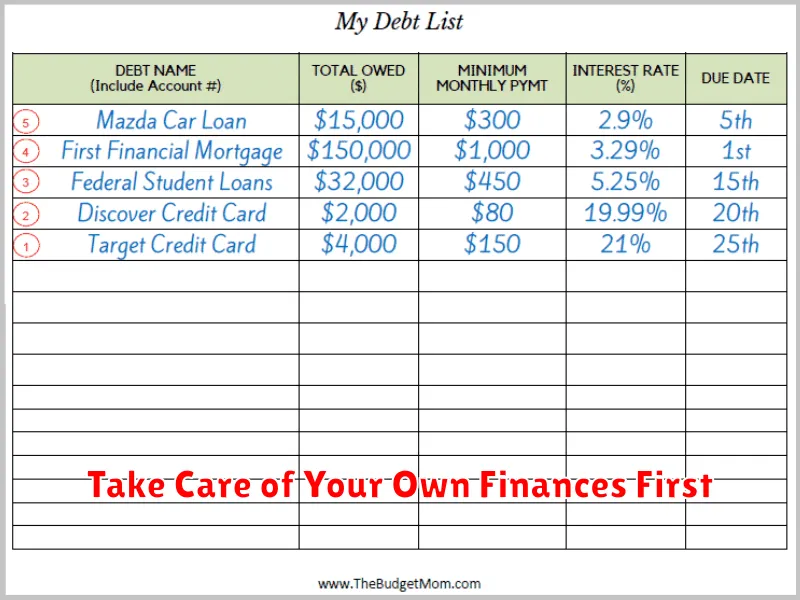

Help Them Create a Debt Plan Together

Creating a debt plan requires a clear understanding of their current financial situation. Sit down with your family member and gather all relevant information. This includes a list of all debts, including credit cards, loans, and medical bills, noting the outstanding balance, interest rate, and minimum payment for each. Also, determine their monthly income and expenses.

Once you have a comprehensive overview, you can begin to explore different debt repayment strategies. Discuss the debt snowball method, where they focus on paying off the smallest debt first for motivation, or the debt avalanche method, where they prioritize high-interest debts to save money in the long run. Help them choose the method that best suits their personality and financial goals.

Creating a realistic budget is essential for successful debt repayment. Work together to identify areas where they can reduce spending. This might involve cutting back on discretionary expenses like dining out or entertainment. Look for opportunities to increase their income, perhaps through a part-time job or selling unused items.

Work together to create a detailed repayment schedule within the budget. This schedule should outline how much they will allocate towards each debt each month. Emphasize the importance of making at least the minimum payment on all debts to avoid further damage to their credit score.

Throughout the process, offer encouragement and support. Remind them that overcoming debt takes time and effort. Celebrate small victories along the way to maintain motivation. Reassure them that you are there to help them through this challenging time.

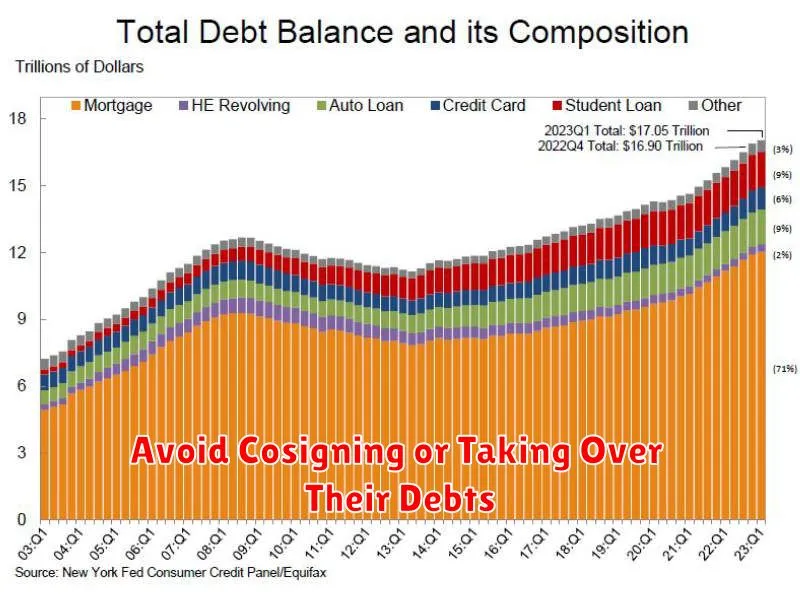

Avoid Cosigning or Taking Over Their Debts

While it’s natural to want to rescue a loved one from financial hardship, cosigning a loan or taking over their debts can have severe negative consequences for your own financial well-being. Cosigning means you’re equally responsible for the debt. If your family member defaults, you’re legally obligated to repay the loan, potentially damaging your credit score and putting your own assets at risk.

Similarly, taking over their debts by paying them off yourself can create a financial strain on your own budget and may not address the underlying issues that led to their debt in the first place. It can also create a pattern of dependence, where the family member relies on you for future financial rescues.

Instead of assuming their financial burdens, focus on empowering them to take control of their situation. Offer support and guidance to help them develop a realistic budget, explore debt management strategies, and seek professional financial counseling. This approach helps them regain financial stability in the long run without jeopardizing your own financial health.

Guide Them Toward Professional Assistance

While offering emotional support and practical advice is helpful, sometimes a family member needs more structured guidance to navigate their debt. Professional financial advisors and credit counselors can provide expert assistance in creating a personalized debt management plan. They can also help negotiate with creditors and explore options like debt consolidation or debt management programs.

Encouraging your loved one to seek professional help is a crucial step. Explain the benefits of working with an expert, such as developing a realistic budget, understanding their debt relief options, and receiving unbiased advice.

Finding reputable professionals is essential. Suggest researching certified financial planners or accredited credit counseling agencies. Advise them to verify credentials and check for any complaints filed against the organization. Attending initial consultations together can offer support and help your family member feel more comfortable.

Remember, while professional assistance is valuable, the individual must be willing to engage with the process. Your role is to support and encourage them to take that step towards financial stability.

Take Care of Your Own Finances First

Before offering any financial assistance to a family member, it’s crucial to assess your own financial situation. Helping someone while jeopardizing your own financial well-being is not sustainable and can lead to problems for both of you.

Create a realistic budget that outlines your income, expenses, and savings goals. Ensure you have an emergency fund in place to cover unexpected costs. Prioritize paying down your own debt and contributing to retirement savings.

Helping a family member should not come at the expense of your own financial security. Be honest with yourself about what you can realistically afford to offer without compromising your financial stability.