Are you struggling with debt and feeling overwhelmed about your financial future? It’s a common challenge, but not an insurmountable one. Learning how to set financial goals while in debt is essential to regaining control of your finances and building a secure future. This article will provide you with a practical guide to setting achievable financial goals, even when you’re facing the pressures of debt. Discover strategies for prioritizing debt repayment, creating a realistic budget, and defining financial goals that align with your overall financial well-being, ultimately paving the way toward financial freedom.

Why Setting Goals Is Still Possible During Debt

Debt can feel overwhelming, often making us feel like our financial future is on hold. However, it’s crucial to understand that setting financial goals remains possible and even essential while managing debt. Having clear objectives provides motivation and a sense of control over your finances, even when facing challenging circumstances.

Setting goals helps shift your focus from the burden of debt to a more positive outlook. It allows you to visualize a future beyond your current situation and work towards achieving specific financial milestones. This can be incredibly empowering and prevent feelings of helplessness that can accompany debt.

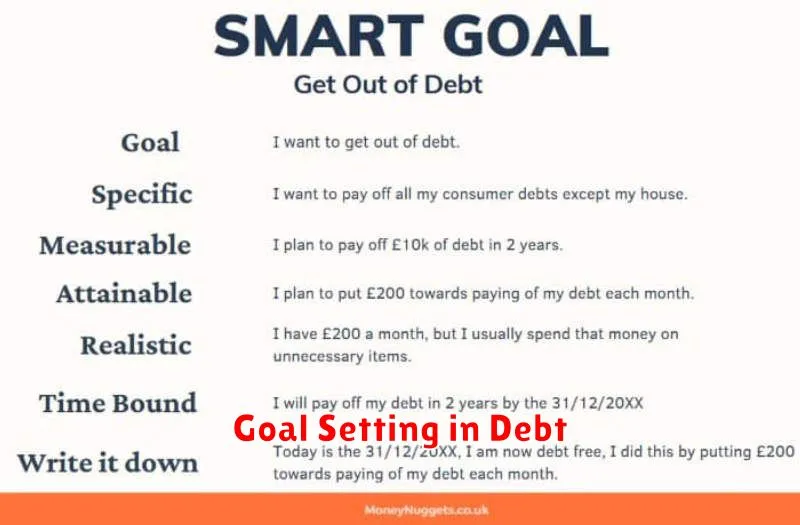

Furthermore, goal setting provides a framework for your debt repayment strategy. By defining specific objectives, such as paying off a particular credit card or reducing your overall debt by a certain percentage, you can create a structured plan to achieve them. This structured approach increases your chances of success and makes the debt repayment process more manageable.

Finally, setting goals while in debt fosters healthy financial habits. The process encourages you to analyze your spending, prioritize your needs, and develop a stronger sense of financial responsibility. These habits not only help you tackle your existing debt but also lay the foundation for a more secure financial future.

Start With Micro Goals to Build Momentum

When facing debt, the idea of achieving large financial goals can feel overwhelming. Instead of aiming for a large, distant target, focus on micro goals. These are small, achievable steps that contribute to your overall financial health. Starting small builds momentum and reinforces positive financial habits.

Examples of micro goals include packing your lunch for a week, brewing your own coffee instead of buying it daily, or canceling one unused subscription. These seemingly insignificant actions can lead to significant savings over time and, more importantly, provide a sense of accomplishment.

This sense of accomplishment is crucial. Successfully reaching micro goals boosts your confidence and encourages you to tackle larger financial challenges. The positive reinforcement creates a cycle of success, building momentum towards debt reduction and long-term financial stability.

Balance Debt Repayment and Emergency Saving

Managing debt while simultaneously building an emergency fund can feel challenging. It requires careful balancing and prioritization. Prioritize high-interest debt, such as credit card debt, while aiming to establish a small, initial emergency fund.

Begin by building an emergency fund of approximately $1,000. This provides a safety net for unexpected expenses, preventing further debt accumulation. Once this initial amount is saved, focus more intensely on aggressively paying down high-interest debts.

After eliminating high-interest debt, shift your focus to building a more robust emergency fund, ideally covering 3-6 months of living expenses. While doing so, continue making consistent payments toward any remaining lower-interest debts, such as student loans or mortgages.

Throughout this process, regularly assess your budget and adjust your savings and debt repayment strategies as needed based on your financial situation. This balanced approach ensures both financial stability and progress towards becoming debt-free.

Create a Timeline for Each Major Goal

A crucial aspect of effective financial goal setting, especially when managing debt, involves establishing a realistic timeline for each goal. This provides a structured approach and helps maintain motivation during the debt repayment process. Timelines create a sense of urgency and allow for measurable progress tracking.

Start by prioritizing your financial goals. High-interest debt typically demands immediate attention. Allocate more resources towards these debts to minimize the overall cost. For goals like saving for a down payment or investing, establish longer timelines, adjusting contributions as debt decreases.

Break down larger goals into smaller, more manageable milestones. Instead of focusing on eliminating $20,000 of debt, concentrate on paying off $1,000 increments. These smaller victories provide a sense of accomplishment and reinforce positive financial behavior.

Be realistic with your timelines. While aggressive debt repayment is beneficial, overly ambitious timelines can lead to discouragement if unforeseen expenses arise. Build some flexibility into your plan to account for potential setbacks.

Regularly review and adjust your timelines as needed. Life circumstances can change, affecting your income or expenses. Periodically assess your progress and modify your timelines to remain aligned with your current financial situation. This ensures your goals remain achievable and relevant.

Use Visual Tools for Motivation

Staying motivated while tackling debt can be challenging. Visual tools can significantly aid in maintaining momentum and providing a tangible sense of progress. Creating a visual representation of your financial goals can transform an abstract idea into a concrete, achievable objective.

Debt thermometers are a popular choice. They visually depict your total debt and the progress you make towards paying it off. As you make payments, you “fill” the thermometer, providing a clear and satisfying visual of how far you’ve come.

Vision boards, though typically associated with broader life goals, can be effective for financial goals too. Include images that represent what you’ll achieve by becoming debt-free, such as a new home, a dream vacation, or simply financial peace of mind. This connects your efforts to a tangible reward.

Spreadsheets or budgeting apps also offer visual tools like charts and graphs. These can track your spending, show the decreasing debt balance over time, and highlight the impact of extra payments. Witnessing these visual changes reinforces positive financial behaviors and encourages continued effort.

Choose a visual tool that resonates with you and use it to track your progress. Regularly updating it provides positive reinforcement and keeps your financial goals top of mind, helping you stay motivated throughout your debt-free journey.

Track Wins Weekly to Stay Encouraged

Staying motivated while tackling debt can be challenging. Tracking your progress, even in small increments, is crucial for maintaining momentum and avoiding discouragement. A weekly review allows you to celebrate small victories and stay focused on your overall financial goals.

Instead of only focusing on the large, looming debt, acknowledge and appreciate the smaller, weekly accomplishments. Did you bring your lunch to work all week instead of eating out? Did you resist an impulse purchase? These small wins build discipline and contribute to your larger debt reduction goal.

Choose a specific day each week to review your finances. Note any instances where you saved money or made progress toward your debt payoff plan. This regular check-in reinforces positive behavior and provides a sense of accomplishment, encouraging you to stay committed to your financial goals.

Adjust Goals Based on Your Financial Progress

Regularly review and adjust your financial goals based on your progress. Life circumstances change, and your financial goals should adapt accordingly. If you receive a raise, consider accelerating your debt repayment or increasing savings contributions. Conversely, if you experience a financial setback, you might need to temporarily scale back your savings goals or extend your debt repayment timeline. Flexibility is key to successfully managing finances while in debt.

Track your progress diligently. This allows you to identify what’s working and what needs modification. If you find a particular strategy isn’t effective, don’t be afraid to change course. Consistent monitoring provides valuable insights into your financial behavior and empowers you to make informed decisions about your goals.

Celebrate your milestones, no matter how small. Acknowledging your achievements reinforces positive financial habits and keeps you motivated throughout your debt repayment journey. These small victories can boost your confidence and encourage you to stay committed to your long-term financial objectives.