Are you struggling with debt and feel like you’re stuck in a never-ending cycle? Many common financial mistakes can exacerbate debt problems, making it harder to achieve financial freedom. This article will explore some of the most detrimental financial mistakes that worsen debt, offering practical advice on how to avoid them and regain control of your finances. Learn how to identify and correct these errors, setting yourself on a path toward debt reduction and a more secure financial future. From ignoring a budget to accumulating high-interest debt, understanding these pitfalls can be the key to breaking free from the debt cycle and achieving your financial goals.

Ignoring Interest Rates and Only Paying Minimums

One of the most detrimental financial mistakes is ignoring interest rates and consistently paying only the minimum amount due on debts like credit cards. This approach significantly extends the repayment period and dramatically increases the overall cost of borrowing.

Minimum payments are designed to primarily cover accrued interest, leaving little room for principal reduction. Consequently, the outstanding balance remains high, accumulating more interest over time. This creates a cycle of debt that becomes increasingly difficult to escape.

Ignoring interest rates compounds the problem. Failing to understand the interest rate associated with a debt prevents borrowers from grasping the true cost of their borrowing. High interest rates can quickly inflate the total amount owed, making seemingly manageable debt spiral out of control.

To avoid this trap, prioritize debt repayment. Calculate the total interest you will pay over the life of the loan if only making minimum payments. This stark reality often serves as motivation to contribute more than the minimum. Even small additional payments can significantly shorten the repayment period and reduce the total interest paid.

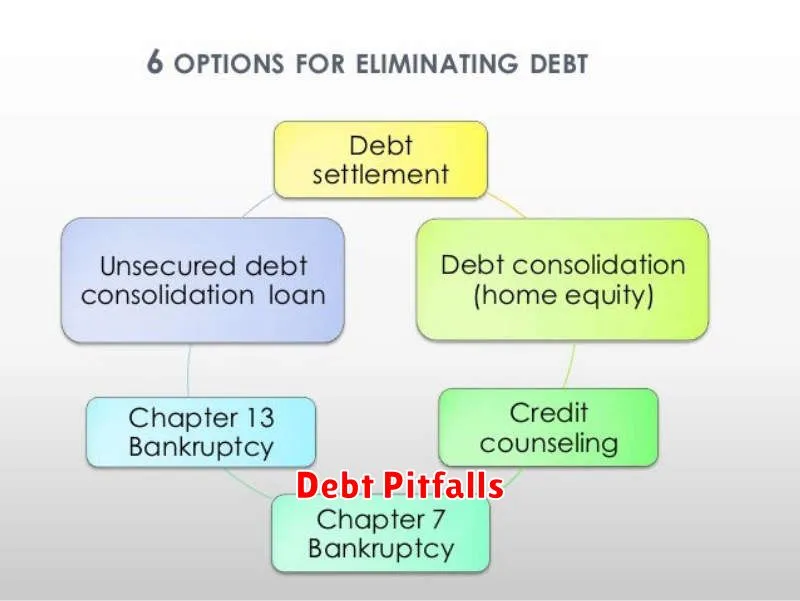

Understanding your interest rate is crucial. Compare rates across different debts and consider strategies like balance transfers or debt consolidation to lower your interest burden and accelerate payoff. By actively managing debt and making informed decisions about repayment, you can avoid the pitfalls of minimum payments and high interest rates.

Taking Out New Loans to Pay Old Ones

While the idea of consolidating debt with a new loan might seem appealing, it can often worsen your financial situation. Taking out a new loan simply to pay off existing debt rarely addresses the root cause of the debt problem, which is usually overspending or inadequate budgeting.

This strategy can create a dangerous cycle of debt. You might end up with a larger overall debt amount due to accumulated interest and fees from the new loan. Furthermore, if the new loan has a longer repayment period, you might end up paying more in interest over time, even if the interest rate appears lower initially. This essentially prolongs the debt burden instead of eliminating it.

Instead of taking on new debt, focus on creating a sustainable budget and addressing the underlying spending habits that contributed to the initial debt. Explore options like the debt snowball or debt avalanche methods to systematically pay down existing loans. Seek guidance from a financial advisor to develop a personalized debt management plan tailored to your specific circumstances.

Maxing Out Credit Cards

Maxing out your credit cards is a serious financial misstep that can significantly worsen your debt situation. Credit utilization, the ratio of your outstanding balances to your total credit limits, plays a crucial role in your credit score. A high utilization rate, especially nearing or at 100%, signals to lenders that you’re heavily reliant on credit, which can negatively impact your credit score. This, in turn, can make it harder to secure loans, obtain favorable interest rates, and even rent an apartment.

High interest rates are another consequence of maxing out credit cards. The more you borrow, the more interest you accrue. This creates a cycle of debt where a larger portion of your payments goes towards interest, making it harder to pay down the principal balance. Additionally, some credit card issuers may increase your interest rate if you consistently max out your card, further exacerbating the problem.

To avoid maxing out your credit cards, create a realistic budget and stick to it. Track your spending and identify areas where you can cut back. Prioritize paying down existing debt, focusing on high-interest cards first. Consider consolidating your debt or seeking professional financial advice if you’re struggling to manage your credit card balances.

Relying on Buy Now Pay Later for Essentials

While “Buy Now, Pay Later” (BNPL) services can seem like a convenient way to manage expenses, relying on them for essential items like groceries, utilities, or rent can be a slippery slope to worsening debt. These services often come with hidden fees and high interest rates if payments aren’t made on time. This can quickly turn everyday purchases into significant debt burdens, especially if you’re already struggling financially.

The ease of using BNPL can create a false sense of affordability, encouraging overspending and making it harder to track your actual spending. This can lead to a cycle of debt where you’re constantly relying on BNPL to cover basic needs, further exacerbating your financial situation.

Instead of relying on BNPL for essentials, focus on creating a realistic budget that prioritizes needs over wants. Explore alternative solutions like community assistance programs or negotiating payment plans directly with service providers. Addressing the root causes of your financial struggles, rather than masking them with short-term financing, is crucial for achieving long-term financial stability.

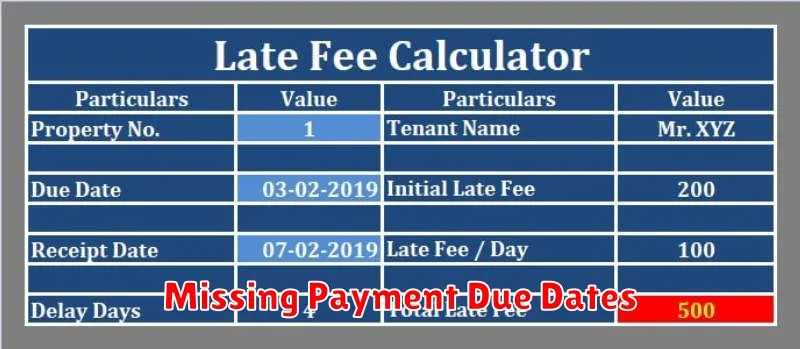

Missing Payment Due Dates

Missing payment due dates is a critical error that significantly exacerbates debt. Each missed payment typically results in a late fee, increasing the overall amount owed. More importantly, late payments negatively impact your credit score. A lower credit score makes it harder to secure loans, obtain favorable interest rates, and even rent an apartment or secure certain jobs. This damage makes managing existing debt more difficult and acquiring new credit more expensive.

To avoid missed payments, set up automatic payments through your bank or creditor’s online portal. This ensures timely payments, even if you forget. Alternatively, set reminders on your phone or calendar a few days before the due date. Prioritize debt payments in your budget, allocating sufficient funds to cover them each month. If you anticipate difficulty making a payment, contact your creditors before the due date. They may offer options like a temporary hardship plan to help you avoid late fees and negative credit reporting.

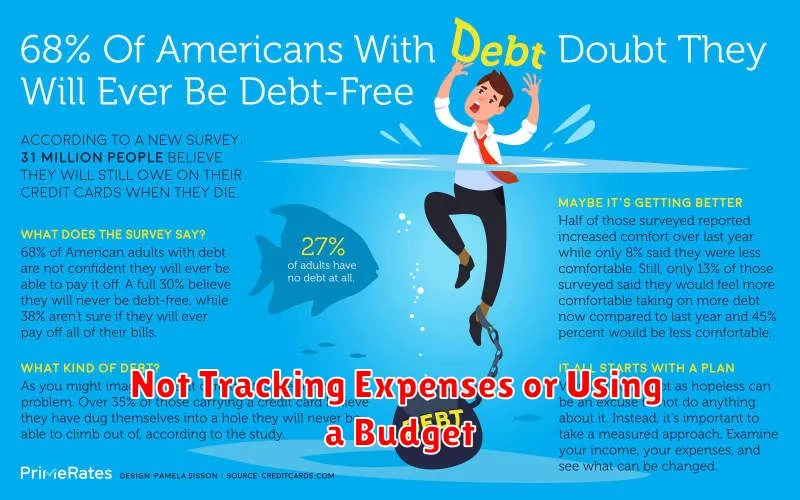

Not Tracking Expenses or Using a Budget

Failing to track expenses and create a budget is a significant contributor to worsening debt. Without a clear picture of where your money goes, it’s easy to overspend and accumulate more debt. Awareness is the first step towards controlling your finances. By tracking your spending, you identify areas where you can cut back and free up money to pay down debt.

A budget acts as a roadmap for your finances. It helps you allocate funds towards essential expenses, debt repayment, and savings goals. Creating a budget involves listing your income and all your expenses. This allows you to prioritize essential spending and identify non-essential expenses that can be reduced or eliminated. Sticking to a budget helps ensure you have enough money to make debt payments on time and avoid accumulating further interest charges.

Several methods exist for tracking expenses, including budgeting apps, spreadsheets, or even a simple notebook. The key is to choose a method that works for you and stick with it. Consistency in tracking and budgeting is crucial for gaining control over your finances and making progress towards debt reduction.

Failing to Ask for Help or Renegotiate Terms

Many individuals struggling with debt make the crucial mistake of suffering in silence. They avoid communicating with their creditors, fearing judgment or embarrassment. This is counterproductive. Proactively reaching out to creditors is often the first step towards a manageable solution.

Creditors are often willing to work with borrowers facing financial hardship. They may offer options such as lowered interest rates, reduced monthly payments, or temporary forbearance. Ignoring the problem only allows interest and penalties to accumulate, exacerbating the situation.

Furthermore, there are numerous non-profit credit counseling agencies that can provide guidance and support. These agencies can help you create a budget, negotiate with creditors on your behalf, and develop a plan to repay your debt. Seeking professional help is a sign of strength, not weakness, and can significantly improve your financial outlook.

Don’t hesitate to explore options like debt consolidation or balance transfers to potentially lower your interest rates and simplify payments. These strategies can be powerful tools when used responsibly and with careful consideration of associated fees.

The key takeaway is to be proactive and communicative. Addressing debt head-on and exploring available options is far more effective than ignoring the problem and allowing it to spiral out of control. Remember, creditors and credit counseling agencies are resources, not adversaries.