Considering debt consolidation? This article explores the crucial question: Should you consolidate your debt? We delve into the pros and cons of debt consolidation, examining the potential benefits like lower interest rates and simplified payments, while also addressing potential drawbacks such as fees and the risk of accumulating more debt. Understanding the intricacies of debt consolidation loans and other strategies is vital before making a decision, so we’ll provide a comprehensive overview to help you determine if consolidating your debt is the right financial move for you.

What Is Debt Consolidation and How It Works

Debt consolidation is a financial strategy where you combine multiple debts, such as credit card balances, personal loans, or medical bills, into a single, new loan with a (hopefully) lower interest rate and a fixed monthly payment. This simplifies debt management by having only one payment to track instead of several.

The process typically involves taking out a new loan, often a personal loan, a home equity loan, or a balance transfer credit card, to pay off your existing debts. You then make regular payments on this new loan until it is paid off in full. The key advantage is potentially securing a lower interest rate, reducing the total interest paid over time and possibly shortening the repayment period.

How it works:

- Assess your debt: List all your debts, including balances, interest rates, and minimum payments.

- Explore consolidation options: Research different loan types and lenders to find the best terms.

- Apply for a consolidation loan: Complete the loan application and provide necessary documentation.

- Receive funds and pay off debts: Once approved, the loan funds are used to pay off your existing creditors directly.

- Make regular payments on the new loan: You’ll now have a single monthly payment to the new lender.

Benefits of Consolidation: One Payment, Lower Interest

Debt consolidation simplifies repayment by combining multiple debts into a single monthly payment. This streamlined approach can make managing finances significantly easier, eliminating the need to track multiple due dates, amounts, and creditors. Instead of juggling various payments, you’ll have just one consistent payment to remember.

In addition to simplified repayment, consolidation can often lead to a lower interest rate. By securing a new loan at a lower rate than your existing debts, you can potentially save a substantial amount of money over the life of the loan. This lower rate translates to less interest paid overall, allowing you to pay off your debt faster and more efficiently.

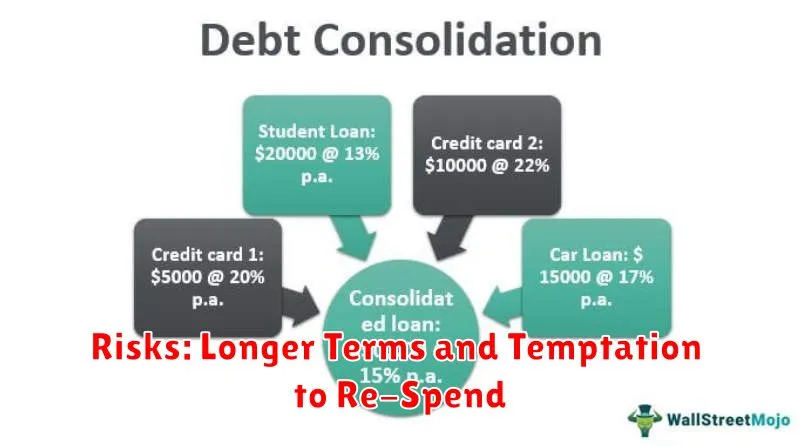

Risks: Longer Terms and Temptation to Re-Spend

While debt consolidation can simplify payments and potentially lower interest rates, it also carries risks. One significant risk is the potential for longer repayment terms. Extending your loan term can result in paying more total interest over the life of the loan, even with a lower interest rate.

Another risk is the temptation to re-spend the credit you’ve freed up. Consolidating debt doesn’t eliminate the underlying spending habits that led to the debt in the first place. If you’re not careful, you could find yourself back in debt quickly, effectively negating the benefits of consolidation.

Know Your Credit Score Before Applying

Before you consider consolidating your debt, it’s crucial to know your credit score. Your credit score plays a significant role in determining the interest rate you’ll qualify for on a consolidation loan. A higher credit score typically translates to lower interest rates, which can lead to substantial savings over the life of the loan. Conversely, a lower credit score might result in higher interest rates, potentially negating the benefits of debt consolidation.

Checking your credit score beforehand allows you to assess your eligibility for favorable loan terms. You can obtain your credit report from the major credit bureaus. Understanding your credit standing empowers you to make informed decisions about whether debt consolidation is the right strategy for your financial situation.

Be aware that applying for multiple loans or credit checks in a short period can potentially lower your credit score. Therefore, it’s advisable to check your score before shopping around for consolidation options to minimize any negative impact.

Compare Offers from Banks and Credit Unions

When considering debt consolidation, comparing offers from various financial institutions is crucial. Interest rates, fees, and loan terms can significantly impact the overall cost of the loan and your ability to repay it. Don’t settle for the first offer you receive.

Banks often offer a wide range of loan products and may have more sophisticated online tools. However, they may also have stricter eligibility requirements. Credit unions, being member-owned, may offer more personalized service and potentially lower interest rates, especially to members in good standing. They might also have more flexible underwriting standards.

Carefully evaluate each offer, paying close attention to the Annual Percentage Rate (APR), which reflects the true cost of borrowing, including fees. Consider the loan term and monthly payment to ensure it aligns with your budget. Finally, examine any prepayment penalties, which could discourage you from paying off the loan faster.

Alternative Options to Consider First

Before consolidating your debt, explore alternative solutions that might be more beneficial in the long run. These options may address the root causes of debt and potentially offer more sustainable financial health.

Budgeting and Expense Tracking: Creating a detailed budget and meticulously tracking expenses can provide valuable insight into spending patterns and identify areas where cuts can be made. This increased awareness can free up funds to pay down debt more aggressively.

Debt Management Plans (DMPs): Non-profit credit counseling agencies offer DMPs, which negotiate lower interest rates and consolidate payments to creditors. While DMPs can be helpful, they typically involve closing existing credit card accounts and may impact credit scores.

The Debt Snowball or Avalanche Methods: These strategies focus on paying down debts strategically. The snowball method targets the smallest debts first for motivation, while the avalanche method prioritizes high-interest debts to minimize overall interest paid.

Balance Transfers: Transferring high-interest balances to a credit card with a 0% introductory APR can provide temporary relief and allow for faster debt reduction. Be mindful of balance transfer fees and ensure you can pay off the balance before the introductory period ends.

Negotiating with Creditors: Contacting creditors directly to negotiate lower interest rates or create a more manageable payment plan is often overlooked. Explain your financial situation honestly and propose a realistic solution.

How to Decide If Consolidation Fits Your Situation

Deciding if debt consolidation is right for you requires careful consideration of your financial situation. Interest rates play a key role. If you can secure a lower interest rate through consolidation, you’ll likely save money and pay off debt faster. However, if the new interest rate is higher or comparable to your current rates, consolidation may not be beneficial.

Fees are another crucial factor. Consolidation often involves origination fees, balance transfer fees, or annual fees. Calculate these costs and factor them into your overall savings calculation. If the fees outweigh the potential interest savings, consolidation might not be worthwhile.

Your credit score significantly impacts your eligibility for consolidation loans and the interest rates offered. A higher credit score typically qualifies you for better terms. Be aware that applying for multiple loans can temporarily lower your credit score.

Consider your debt repayment habits. Consolidation simplifies your debt into a single payment, but it doesn’t address underlying spending habits. If overspending contributed to your debt, consolidation alone won’t solve the problem. A commitment to responsible spending is crucial for long-term financial health.

Finally, evaluate the terms and conditions of the consolidation loan. Pay close attention to the repayment period, any prepayment penalties, and the impact on your credit report. A longer repayment period might result in lower monthly payments, but you could end up paying more interest over time.