Managing multiple debts can feel overwhelming, but creating a budget is the first crucial step toward financial freedom. This article provides a comprehensive guide on how to build a budget while simultaneously paying off multiple debts. Learn effective debt management strategies, including prioritizing debts, exploring debt consolidation options, and developing a realistic budget that allows for debt repayment while covering essential expenses. Gain control of your finances and embark on a path toward a debt-free future by mastering the art of budgeting while tackling multiple debts.

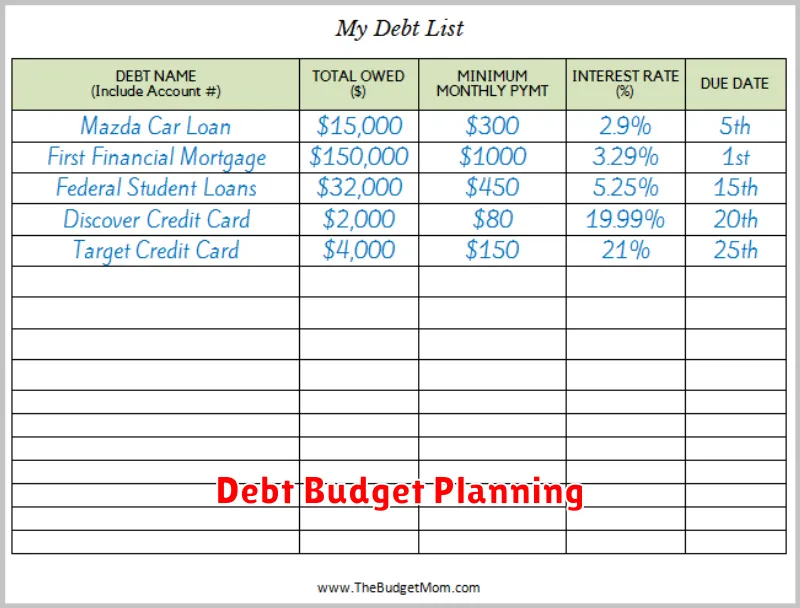

List All Debts, Minimums, and Due Dates

The first step in effectively managing multiple debts is to create a comprehensive list. This list should include every debt you owe, from credit cards and student loans to personal loans and medical bills. Be thorough and don’t omit anything, even small debts.

For each debt, list the following information:

- Creditor: The name of the institution or individual you owe.

- Total Balance: The current total amount you owe.

- Minimum Payment: The minimum amount due each month.

- Interest Rate: The annual percentage rate (APR) being charged.

- Due Date: The date your payment is due each month.

Organizing this information in a spreadsheet or using a debt tracking app can be extremely helpful. This allows you to sort and filter your debts, providing a clear overview of your financial obligations. Accuracy is crucial in this step. Double-check all entries to ensure the information is correct.

Having a complete and accurate list of your debts, minimum payments, and due dates is the foundation for building a successful debt repayment plan and a sustainable budget.

Build a Budget Around Fixed Payments First

When managing multiple debts, establishing a structured budget is crucial. Begin by prioritizing fixed payments. These are expenses that remain the same each month, such as rent or mortgage payments, car loans, and minimum debt payments. Accurately accounting for these amounts ensures you allocate sufficient funds to meet these obligations, preventing late payments and potential negative impacts on your credit score.

List each fixed payment and its due date. This creates a clear overview of your essential expenses. Once you’ve accounted for all fixed payments, you can then determine how much disposable income remains for variable expenses like groceries, entertainment, and additional debt payments.

Building your budget around fixed payments first provides a stable foundation. This approach helps prevent overspending and allows for better allocation of remaining funds towards achieving your debt payoff goals.

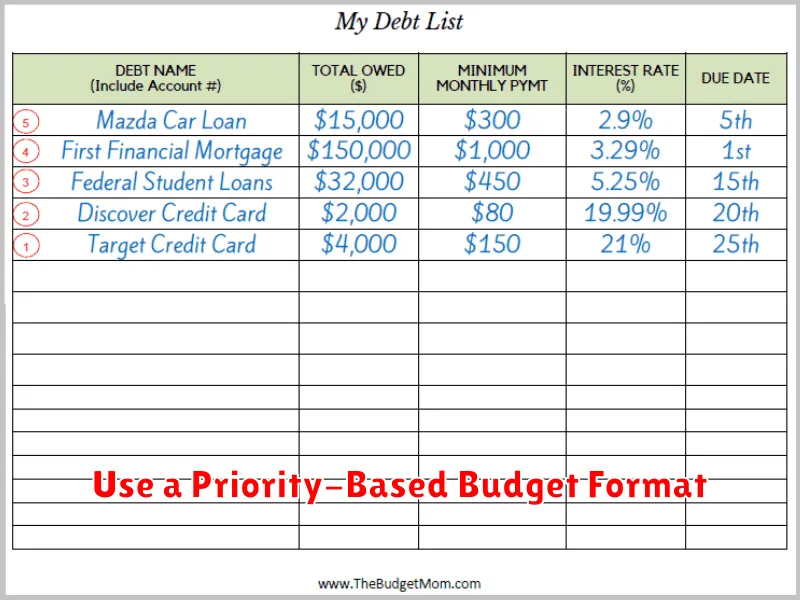

Use a Priority-Based Budget Format

When juggling multiple debts, a priority-based budget is crucial. This format ensures you allocate funds effectively, targeting high-interest debts while covering essential expenses.

Start by listing your essential expenses: housing, food, utilities, and transportation. Then, list your debts, including the minimum payment and the interest rate for each.

Prioritize your debts based on interest rate, starting with the highest. Allocate any funds beyond your essential expenses and minimum payments to the debt with the highest interest. This approach saves you money on interest payments in the long run. Once the highest-interest debt is paid, move on to the next highest, continuing this process until all debts are cleared.

This method, often referred to as the debt avalanche method, helps you become debt-free more quickly and efficiently compared to other methods like the debt snowball.

Include a Small Buffer for Unexpected Costs

When building a budget, especially while tackling multiple debts, it’s crucial to incorporate a buffer for unforeseen expenses. Life rarely goes exactly as planned, and unexpected costs can easily derail your debt repayment progress if you haven’t prepared for them.

This buffer acts as a safety net, preventing you from having to rely on credit cards or take out additional loans when unexpected events occur. These events might include car repairs, medical bills, home maintenance, or even a temporary loss of income.

Determine a reasonable amount to allocate to this buffer based on your individual circumstances and typical monthly expenses. Even a small amount can make a significant difference in your ability to stay on track with your debt repayment plan. This buffer isn’t meant for discretionary spending; its purpose is solely for absorbing unexpected financial hits.

Cut Back on Discretionary Spending for Speed

Accelerating your debt repayment journey requires strategic spending cuts. Focus on discretionary spending – those non-essential expenses that enhance your lifestyle but aren’t crucial for survival. This category often includes dining out, entertainment subscriptions, hobbies, and luxury items.

Temporarily reducing or eliminating these expenses can free up substantial cash flow to redirect towards your debt. Analyze your spending habits to identify areas where you can comfortably cut back. Small changes, like brewing coffee at home instead of buying it daily, can accumulate significant savings over time.

Prioritize your financial goals. While these cutbacks might require temporary lifestyle adjustments, the long-term benefits of becoming debt-free outweigh the short-term sacrifices. Remember, this is a temporary measure to achieve faster debt repayment and regain financial stability.

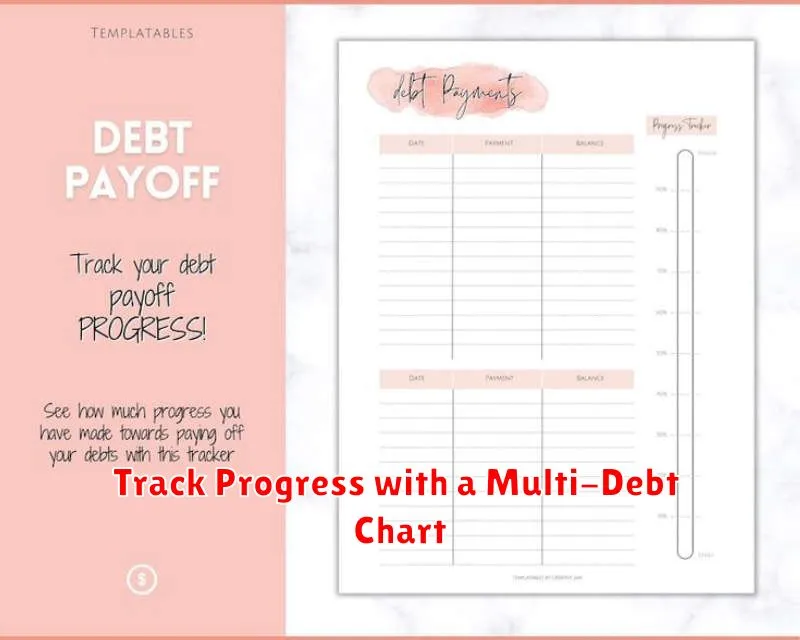

Track Progress with a Multi-Debt Chart

Managing multiple debts can feel overwhelming. A multi-debt chart provides a clear visual representation of your progress, helping you stay motivated and organized. This chart allows you to track key information for each debt, such as the creditor, total balance, minimum payment, interest rate, and payoff date.

Creating a multi-debt chart is straightforward. You can use a simple spreadsheet program, a printable template, or even a piece of paper. List each debt individually, including all the relevant information mentioned above. As you make payments, update the remaining balance and projected payoff date. This visual representation helps you understand the impact of your payments and stay focused on your debt-free goal.

The power of a multi-debt chart lies in its ability to demonstrate progress. Seeing the balances decrease and the payoff dates draw nearer can be incredibly motivating. It also allows you to easily compare your debts and identify areas where you can potentially accelerate your payoff strategy, such as prioritizing high-interest debts or making additional payments when possible. The chart provides a tangible record of your financial journey, reinforcing your commitment to becoming debt-free.

Adjust Payments as Debts Get Cleared

As you begin to pay off your debts, you’ll find your budget gradually freeing up. Don’t let this extra money disappear into miscellaneous spending. Instead, re-allocate it towards your remaining debts.

When you completely pay off one debt, take the amount you were paying on it and add it to the payment for another debt. This is often referred to as the “debt snowball” or “debt avalanche” method. The debt snowball focuses on paying off the smallest debts first for motivation, while the debt avalanche prioritizes high-interest debts to save money on interest payments. Choose the strategy that best suits your financial situation and personality.

For example, imagine you’re paying $50 towards a credit card and $100 towards a student loan. Once the credit card is paid off, redirect that $50 towards the student loan, increasing your monthly payment to $150. This accelerated payment will help you become debt-free faster.

Regularly review and adjust your budget as debts are cleared. This allows you to maintain momentum and ensures you’re always making the most effective use of your available funds.

Tracking your progress is crucial. Use a spreadsheet, budgeting app, or even a simple notebook to monitor your debt balances and payments. Seeing the numbers decrease can provide strong motivation to continue your debt payoff journey.