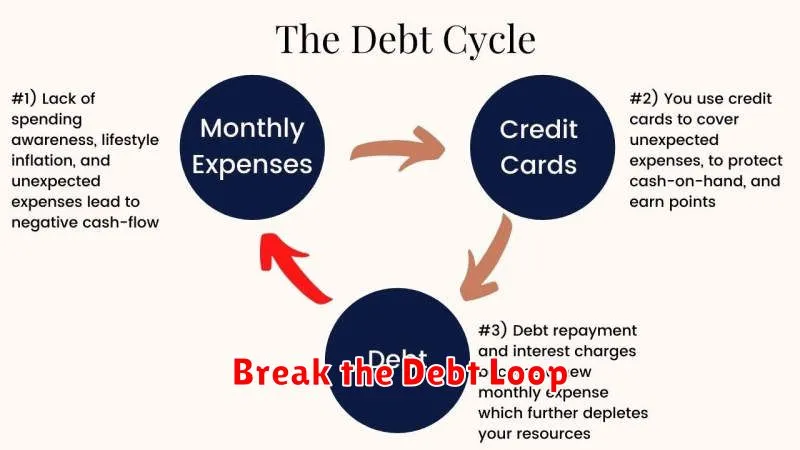

Are you trapped in a seemingly endless cycle of debt, feeling like you’re losing control of your finances? This article provides actionable steps to help you stop the cycle of debt and regain control of your money. Learn how to break free from debt, develop a sustainable budget, and build a more secure financial future. We’ll explore effective strategies for debt management, debt reduction, and ultimately, achieving financial freedom. Take the first step towards a debt-free life and discover how to take back control of your finances today.

Recognize Your Debt Patterns

The first step to breaking the cycle of debt is to understand your spending habits and identify recurring patterns that contribute to your debt. This involves honestly assessing where your money goes and pinpointing the root causes of your financial challenges.

Start by tracking your expenses for a specific period, whether it’s a month or several months. Categorize your spending (e.g., housing, food, transportation, entertainment) to gain a clear picture of your financial outflows. Look for trends, such as overspending on non-essential items or relying heavily on credit cards to cover regular expenses.

Emotional spending can be a significant contributor to debt. Identify any emotional triggers (stress, boredom, sadness) that lead to impulsive purchases. By recognizing these patterns, you can develop strategies to manage emotional spending and make more conscious financial decisions.

Analyzing your debt patterns also involves understanding the types of debt you hold. Differentiate between high-interest debt (credit cards) and lower-interest debt (student loans or mortgages). Prioritizing high-interest debt repayment is often the most effective approach to reducing overall debt.

Finally, consider the timing of your debt accumulation. Does your debt tend to increase during certain times of the year? Understanding seasonal spending patterns can help you anticipate and plan for these periods, preventing further debt buildup.

Break Emotional Spending Habits First

Emotional spending is a significant contributor to the cycle of debt. It’s driven by feelings, not logic, and often leads to regret and financial strain. Before tackling budgets and repayment plans, address the root cause: your emotional relationship with money.

Identify your spending triggers. Are you buying things when you’re stressed, bored, sad, or lonely? Recognizing these patterns is the first step to breaking them. Keep a spending journal, noting not just what you bought, but how you felt at the time. This will help you pinpoint the emotions driving your purchases.

Find healthy coping mechanisms to replace shopping. Exercise, meditation, spending time in nature, or connecting with loved ones can provide emotional relief without emptying your wallet. When you feel the urge to spend emotionally, consciously choose one of these alternatives.

Delay gratification. When you feel the impulse to buy something, wait 24 hours. This cooling-off period often helps you realize the purchase wasn’t truly necessary. Ask yourself: “Do I really need this, or am I just trying to fill an emotional void?”

Seek professional support if necessary. A therapist or financial counselor can provide guidance and tools to help you understand and manage your emotional spending habits. They can offer personalized strategies to develop a healthier relationship with money and break free from the cycle of debt.

Cut Up or Freeze Credit Cards Temporarily

One effective method to curb spending and regain control of your debt is to temporarily disable your credit cards. This can be done by physically cutting up the cards or, for a less permanent solution, placing a freeze on them.

Cutting up your cards offers a tangible and immediate break from the temptation to use them. This symbolic act can be psychologically empowering, providing a sense of control over your finances. However, it’s crucial to remember that cutting up the card doesn’t close the account. You are still responsible for any outstanding balance and associated interest charges.

A credit freeze is a more sophisticated approach. It prevents new credit from being opened in your name. This protects you from identity theft and also makes it harder to impulsively apply for new credit lines. A freeze can be lifted temporarily if you need to apply for new credit, but it requires proactive steps on your part, adding a layer of friction against impulsive spending.

Whether you choose to cut up your cards or implement a freeze, these actions represent powerful first steps toward breaking the cycle of debt and reclaiming control of your financial well-being. They force you to rely on existing funds and create a breathing space to reassess your spending habits and develop a sustainable budget.

Create a Barebones Budget to Regain Control

A barebones budget is the most essential tool for breaking the debt cycle. It focuses on prioritizing needs over wants to free up cash flow for debt repayment. This process requires ruthless honesty about your spending habits.

Begin by tracking every expense. Categorize them as essential (rent, utilities, groceries) or non-essential (dining out, entertainment, subscriptions). Non-essential spending is where you’ll find opportunities to cut back.

Next, create a realistic budget that prioritizes your needs. Identify areas where you can reduce non-essential expenses. Even small savings can contribute significantly over time. This might mean canceling streaming services, brewing coffee at home, or bringing lunch to work.

The goal is to create a surplus. Every extra dollar you can find should be directed towards paying down debt, starting with the highest interest balances. This disciplined approach will help you regain control of your finances and accelerate your journey out of debt.

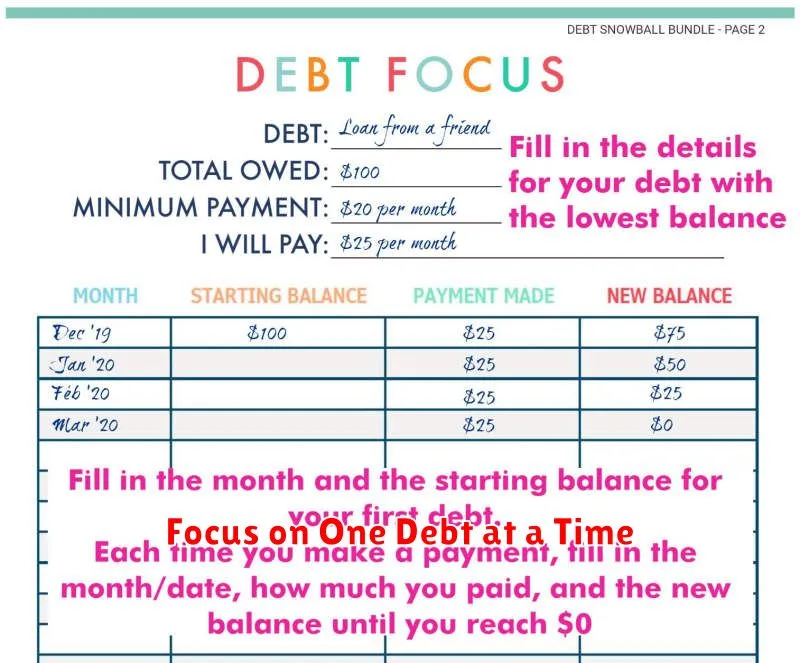

Focus on One Debt at a Time

Trying to tackle all your debts simultaneously can feel overwhelming and ultimately unproductive. Instead, concentrate your efforts on one debt at a time. This focused approach allows you to dedicate more resources to paying down that specific debt quicker, building momentum and creating a sense of accomplishment as you progress.

There are two primary methods for prioritizing your debt: the debt avalanche and the debt snowball. The debt avalanche method prioritizes the debt with the highest interest rate. Paying this off first minimizes the total interest you’ll pay over time. The debt snowball method focuses on the smallest debt balance, regardless of the interest rate. This provides a psychological boost as you quickly eliminate debts, motivating you to continue.

Choose the method that best suits your personality and financial situation. Regardless of your choice, consistency is key. Once you’ve selected a debt to target, maintain focus until it’s paid off completely before moving on to the next.

Celebrate Debt-Free Milestones and Reinforce Discipline

Achieving financial freedom requires ongoing discipline, and acknowledging progress is crucial for maintaining momentum. Celebrating debt-free milestones, no matter how small, reinforces positive behavior and provides motivation to continue the journey.

When you pay off a credit card or reach a significant percentage of your debt reduction goal, take time to acknowledge the accomplishment. This doesn’t necessitate extravagant spending; rather, focus on activities that align with your financial goals. Consider a small, budget-friendly reward like a special meal at home or a free activity such as a hike or a picnic. The key is to associate positive feelings with your progress, making the process more enjoyable and sustainable.

Recognizing these milestones also strengthens your commitment to staying out of debt. By consciously linking positive emotions with responsible financial behavior, you’re effectively rewiring your mindset. This, in turn, helps you resist impulsive spending and reinforces the discipline required to maintain long-term financial stability.

Documenting your progress can be a powerful tool as well. Keep a visual tracker of your debt reduction journey. Seeing the progress visually can provide a sense of accomplishment and further motivate you to continue on the path toward financial freedom.

Finally, use these milestones as opportunities to reflect on the strategies that have proven effective. Analyzing what worked well and identifying areas for improvement allows you to refine your approach and continue making consistent progress toward your ultimate goal of being debt-free.

Replace Spending Habits with Positive Activities

Breaking the cycle of debt requires addressing the underlying spending habits that contribute to it. Often, spending is tied to emotional triggers like stress, boredom, or loneliness. Replacing these negative spending habits with positive activities is crucial for long-term financial health.

Identify your spending triggers. Are you prone to retail therapy after a tough day? Do you order takeout when you’re feeling down? Once you’re aware of these triggers, you can begin to substitute them with more constructive behaviors. Instead of hitting the mall, consider going for a walk, meditating, or calling a friend. Instead of ordering in, explore a new recipe or engage in a hobby.

Free or low-cost activities offer a wealth of alternatives to spending. Exploring local parks, visiting free museums, joining a book club, or volunteering your time can provide fulfillment and enjoyment without straining your finances. Focusing on experiences rather than material possessions can be a powerful shift in mindset.

This substitution process takes time and effort. Be patient with yourself and celebrate small victories. Each time you choose a positive activity over a spending spree, you’re reinforcing a healthier habit and taking a step towards financial freedom.