Feeling overwhelmed by debt and the constant pressure from creditors? This article provides practical strategies on how to talk to creditors effectively, negotiate lower payments, and reduce your debt stress. Learn how to communicate confidently with creditors, explore options for debt consolidation or debt management, and develop a plan to regain control of your finances and achieve financial freedom.

Why Communication Is Key With Creditors

Open communication with creditors is crucial for managing debt and minimizing stress. Ignoring calls and letters will only exacerbate the situation, potentially leading to more aggressive collection efforts. By proactively contacting your creditors, you demonstrate a willingness to address your financial obligations.

Talking to your creditors allows you to explain your circumstances and explore potential solutions. They may be willing to negotiate more manageable payment terms, reduce interest rates, or offer hardship programs. Transparency about your financial situation can lead to more favorable outcomes.

Early communication can help prevent negative impacts on your credit report. While late payments may still be reported, demonstrating an effort to work with creditors can show responsible financial behavior and potentially mitigate some of the damage.

Finally, communicating with creditors can significantly reduce your debt-related stress. By addressing the situation head-on, you gain a sense of control and reduce the anxiety associated with uncertainty. A clear understanding of your options and a collaborative relationship with your creditors can make the debt repayment process much less daunting.

Prepare Your Financial Details in Advance

Before contacting your creditors, gather all necessary financial information. This includes a list of all your debts, including creditor names, account numbers, balances, minimum payments, and interest rates.

Calculate your monthly income and expenses. Having a clear picture of your budget will help you understand how much you can realistically afford to pay towards your debts.

Review your credit report. Check for any inaccuracies and understand your current credit standing, as this can affect your negotiations.

Prepare a proposed payment plan. Based on your budget, determine what you can realistically offer your creditors. Having a concrete proposal ready can make the conversation more productive.

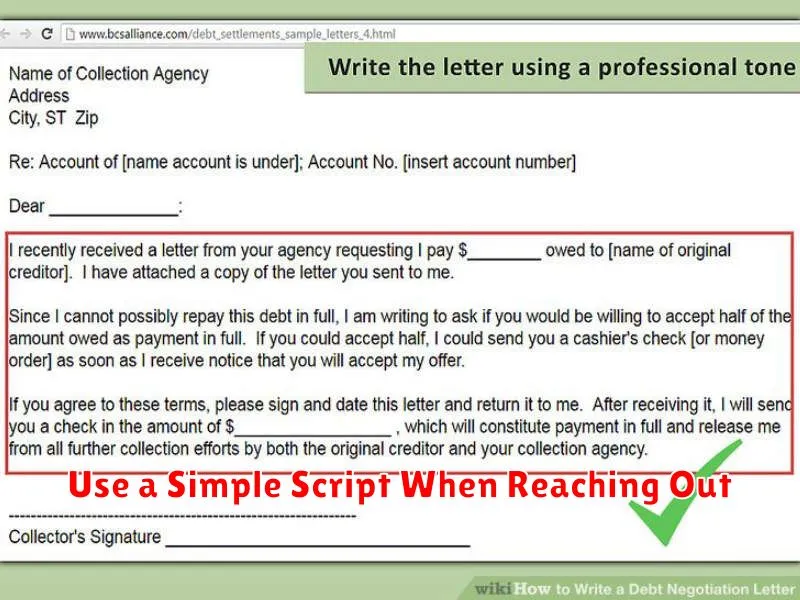

Use a Simple Script When Reaching Out

Talking to creditors can feel intimidating, but having a prepared script can ease the process. This allows you to stay focused and clearly communicate your situation.

Start by identifying yourself and the account in question. Then, briefly explain why you are calling – for example, to discuss payment options or to request a hardship plan. Be honest about your current financial situation and the challenges you’re facing.

Clearly state what you are hoping to achieve. Are you requesting a lower interest rate, a waived late fee, or a revised payment plan? Having a specific goal in mind will make the conversation more productive.

Finally, be prepared to listen carefully to the creditor’s response and ask clarifying questions. Take notes on the conversation, including the date, time, and the name of the representative you spoke with. This documentation can be helpful for future reference.

A sample script might look like this:

“Hello, my name is [Your Name] and I’m calling about account number [Your Account Number]. I’m currently facing financial hardship due to [brief explanation]. I’m calling to discuss options for making my payments more manageable. I’m hoping we can work together to create a payment plan that works for both of us. Could you tell me about the available options?”

Remember, being polite and respectful throughout the conversation is crucial. Even though you are experiencing financial difficulties, maintaining a professional demeanor will increase the likelihood of a positive outcome.

Ask for Lower Interest, Payment Plan, or Pause

Proactively contacting your creditors is crucial when facing debt challenges. Don’t wait until you’re severely delinquent. Explain your situation honestly and clearly. You may be surprised at their willingness to work with you.

Negotiate a lower interest rate. A reduced interest rate can significantly decrease your monthly payments and the overall amount you pay back. Be prepared to explain why you’re requesting a lower rate, such as a job loss or medical expenses. Having a good payment history prior to your hardship can strengthen your case.

Explore payment plan options. If a lower interest rate isn’t feasible, a revised payment plan might be possible. This could involve extending the repayment period or reducing your monthly payments to a more manageable amount. Be aware that extending the repayment period could result in paying more interest overall.

Request a temporary forbearance or deferment. In certain situations, creditors may grant a temporary pause or reduction in payments. This can provide breathing room while you address financial difficulties. Be sure to understand the terms of any forbearance or deferment, including when payments resume and any accrued interest.

Document everything. Keep records of all communication with your creditors, including names, dates, and agreements reached. This documentation can be invaluable if any disputes arise later.

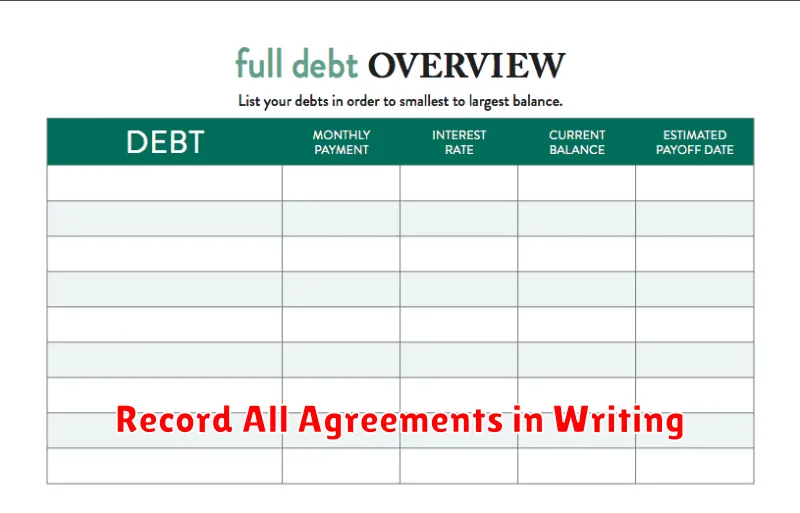

Record All Agreements in Writing

Documenting every agreement with creditors is crucial for protecting yourself and ensuring clarity. A written record prevents misunderstandings and provides proof of the terms agreed upon. This applies to any changes in payment schedules, interest rates, or settlement amounts.

When you reach a verbal agreement, immediately follow up with a written confirmation. Request that the creditor send you a written agreement outlining the revised terms. Keep copies of all correspondence, including emails, letters, and payment confirmations.

This written record serves as evidence if a dispute arises later. It can also help you track your progress and hold both yourself and the creditor accountable to the agreed-upon terms. A clear, documented agreement reduces stress and provides peace of mind during the debt management process.

Stay Polite But Firm

When communicating with creditors, maintaining a respectful and assertive stance is crucial. Remember, creditors are also bound by rules and regulations. While expressing your financial difficulties, avoid apologetic or pleading tones. Instead, clearly and concisely explain your current situation and propose realistic solutions.

Politeness demonstrates professionalism and encourages cooperation. Use courteous language, actively listen to their responses, and acknowledge their perspective. This approach fosters a more productive conversation.

Firmness, on the other hand, signals that you’re serious about resolving the debt and expect fair treatment. Clearly state your proposed payment plan or settlement offer. Be prepared to negotiate, but stand your ground if the creditor’s demands are unreasonable or unaffordable.

Balancing these two qualities can help you achieve a mutually beneficial outcome. Being polite but firm can open doors to negotiation and potentially reduce your debt burden without sacrificing your dignity or financial stability.

Follow Up and Track Commitments Weekly

Consistent follow-up is crucial for successful debt management. Schedule a specific time each week to review your payment agreements, track payments made, and ensure you’re meeting your commitments.

This weekly check-in allows you to: monitor your progress, identify any potential issues, and stay proactive in your communication with creditors. If you anticipate a missed payment, contact your creditor immediately to discuss options and avoid further complications.

Use a spreadsheet, budgeting app, or even a simple notebook to record your payment schedules and amounts. This provides a clear overview of your debts and helps you stay organized throughout the repayment process. Documenting your communications with creditors (dates, times, and outcomes) is also highly recommended.

By diligently tracking your progress and maintaining open communication, you build trust with your creditors and demonstrate your commitment to resolving your debt. This proactive approach can significantly reduce stress and help you regain control of your finances.