Creating a realistic debt payoff plan is crucial for achieving financial freedom. This guide provides a step-by-step approach to developing a debt management strategy that works for your budget and helps you eliminate debt effectively. Learn how to prioritize debts, negotiate with creditors, explore debt consolidation options, and ultimately create a sustainable plan to become debt-free.

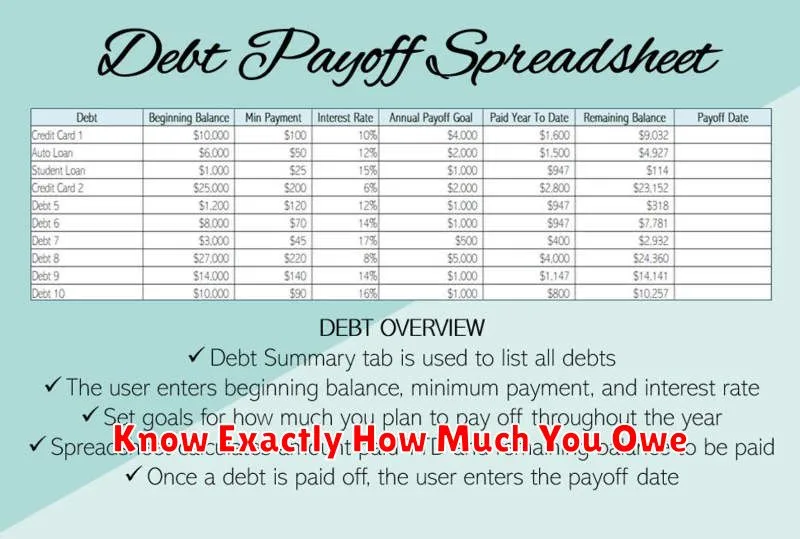

Know Exactly How Much You Owe

The foundation of any successful debt payoff plan is a clear understanding of your current debt landscape. This means knowing exactly how much you owe to each creditor. List every single debt, including credit cards, student loans, personal loans, auto loans, and any other outstanding balances. Don’t forget less obvious debts like medical bills or money borrowed from family or friends.

For each debt, record the creditor’s name, the total balance owed, the minimum monthly payment, and the interest rate. This information is crucial for prioritizing your debt repayment strategy and tracking your progress. Accuracy is paramount; double-check your numbers against your most recent statements to ensure you have the correct information.

Creating a spreadsheet or using a debt tracking app can be incredibly helpful in organizing this information. It allows you to see the full picture of your debt and easily update your progress as you pay it down.

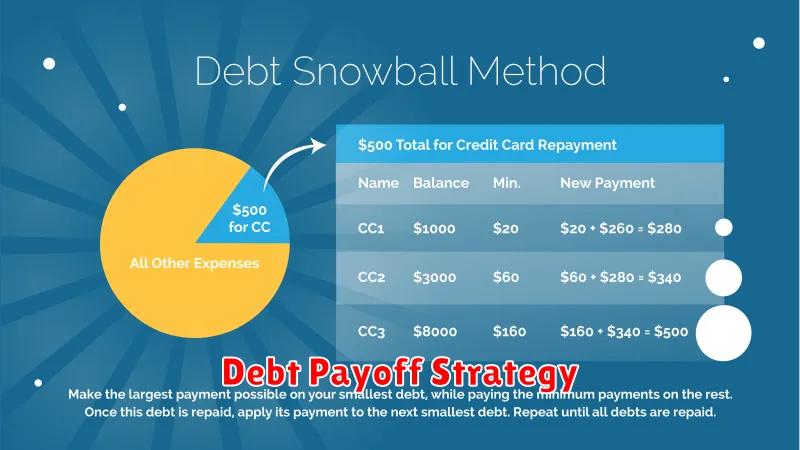

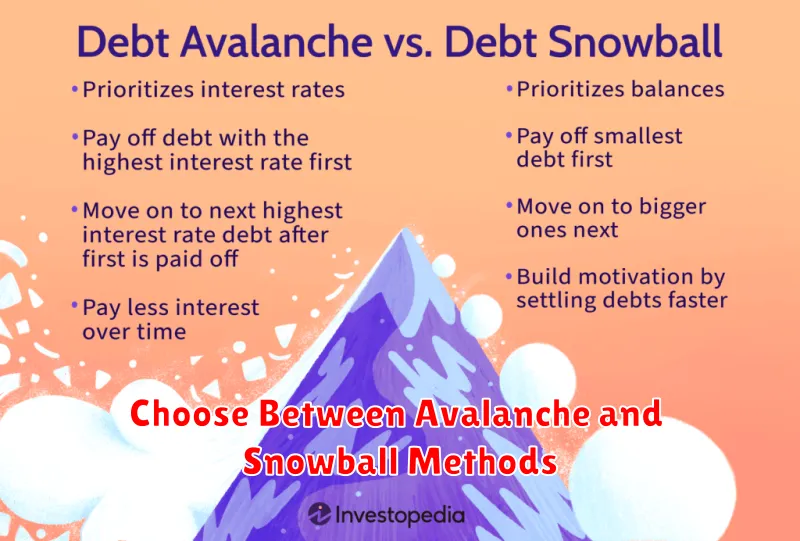

Choose Between Avalanche and Snowball Methods

When crafting a debt payoff plan, two popular methods stand out: the Avalanche and the Snowball methods. Both involve prioritizing certain debts while making minimum payments on others, but they differ in their approach.

The Avalanche method prioritizes debts with the highest interest rates. By tackling high-interest debt first, you minimize the total interest paid over time, saving money in the long run. This method is mathematically the most efficient.

The Snowball method, on the other hand, focuses on the smallest debt balances, regardless of interest rate. By paying off smaller debts quickly, you gain a sense of momentum and motivation, which can be crucial for staying on track. This psychological advantage can be particularly helpful for those who find debt repayment daunting.

Choosing between the two depends on your financial situation and personality. If you’re highly motivated and prioritize psychological wins, the Snowball method might be a good fit. However, if you’re more focused on minimizing total cost and have the discipline to stick with the plan, the Avalanche method is generally the more financially sound choice.

Prioritize High-Interest Debt First

When creating a debt payoff plan, prioritize high-interest debt like credit cards and payday loans. These debts accrue interest quickly, increasing your overall balance faster than lower-interest debts like student loans or mortgages. Focusing on high-interest debt first minimizes the total interest paid over time, saving you money in the long run.

While it can be tempting to tackle smaller debts first for a sense of accomplishment, it’s financially more effective to address the most expensive debt first. Calculate the interest you’re paying on each debt and rank them from highest to lowest. Devote as much extra payment as possible towards the highest-interest debt while making minimum payments on the others.

Set a Monthly Payoff Goal You Can Sustain

Creating a realistic debt payoff plan requires setting a monthly payment goal that you can consistently maintain. This involves a careful assessment of your current income and expenses.

Begin by tracking your spending for a month to understand where your money goes. Categorize your expenses into essential (housing, food, transportation) and non-essential (entertainment, dining out). This will reveal areas where you can potentially reduce spending.

Once you have a clear picture of your finances, determine the maximum amount you can realistically allocate towards debt repayment each month. This amount should not jeopardize your ability to cover essential expenses and maintain a reasonable standard of living. It’s crucial to choose a sustainable amount, even if it seems small, to ensure long-term success.

Remember, paying off debt is a marathon, not a sprint. A smaller, sustainable monthly payment consistently applied over time is more effective than a larger, unsustainable payment that leads to burnout and discouragement.

Consider using a budgeting app or spreadsheet to help you stay organized and track your progress. Regularly review your budget and adjust your payoff goal as needed, particularly if your income or expenses change.

Automate Minimum Payments and Add Extra When Possible

Automating your minimum payments ensures you avoid late fees and negative impacts to your credit score. Set up automatic payments through your bank or directly with each creditor.

While making minimum payments is crucial for staying current, it’s the slowest and most expensive way to eliminate debt. Prioritize paying extra whenever possible. Even small additional amounts can significantly shorten your repayment timeline and reduce the total interest paid.

Consider allocating any windfalls, such as bonuses, tax refunds, or raises, towards your debt. These extra payments can accelerate your progress considerably. Regularly review your budget to identify areas where you can cut back and redirect funds to debt repayment.

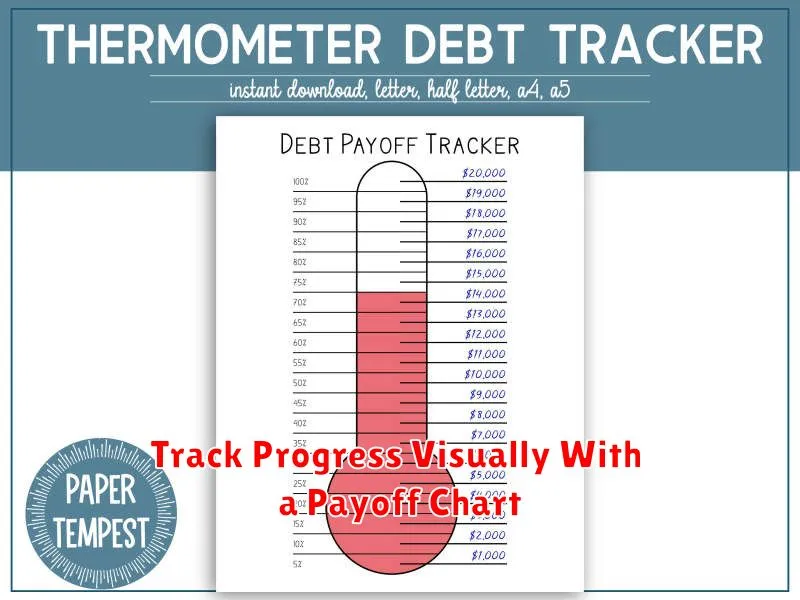

Track Progress Visually With a Payoff Chart

A payoff chart offers a powerful visual representation of your debt reduction journey. It helps you track progress, stay motivated, and see the tangible impact of your payments.

Several methods exist to create a payoff chart. You can use a spreadsheet program like Google Sheets or Microsoft Excel, design one by hand, or utilize a debt payoff chart template available online. The key is to input all your debts, including the balance, interest rate, and minimum payment.

As you make payments, update your chart to reflect the decreasing balances. Visually seeing your progress, even small wins, is crucial for maintaining momentum and commitment to your debt payoff plan.

The chart allows you to readily see the impact of different payoff strategies. For example, you can compare the effects of the debt snowball or debt avalanche methods and adjust your approach as needed. This visualization reinforces your efforts and keeps you focused on your ultimate goal of becoming debt-free.

Celebrate Small Wins Along the Way

A debt payoff journey can be long and challenging. It’s crucial to acknowledge and celebrate small victories to maintain motivation and momentum. Don’t wait until you’re completely debt-free to feel a sense of accomplishment.

Recognize milestones, no matter how small. Paying off a small credit card balance, reaching a certain percentage of your debt payoff goal, or even consistently sticking to your budget for a month are all worth celebrating.

These small wins reinforce positive behavior and provide the encouragement needed to continue on the path to financial freedom. Acknowledge your progress and reward yourself in affordable ways. This could be a special meal, a small gift, or a fun activity that doesn’t derail your budget.

Celebrating small wins not only helps you stay motivated but also reinforces the positive changes you’re making in your financial habits.